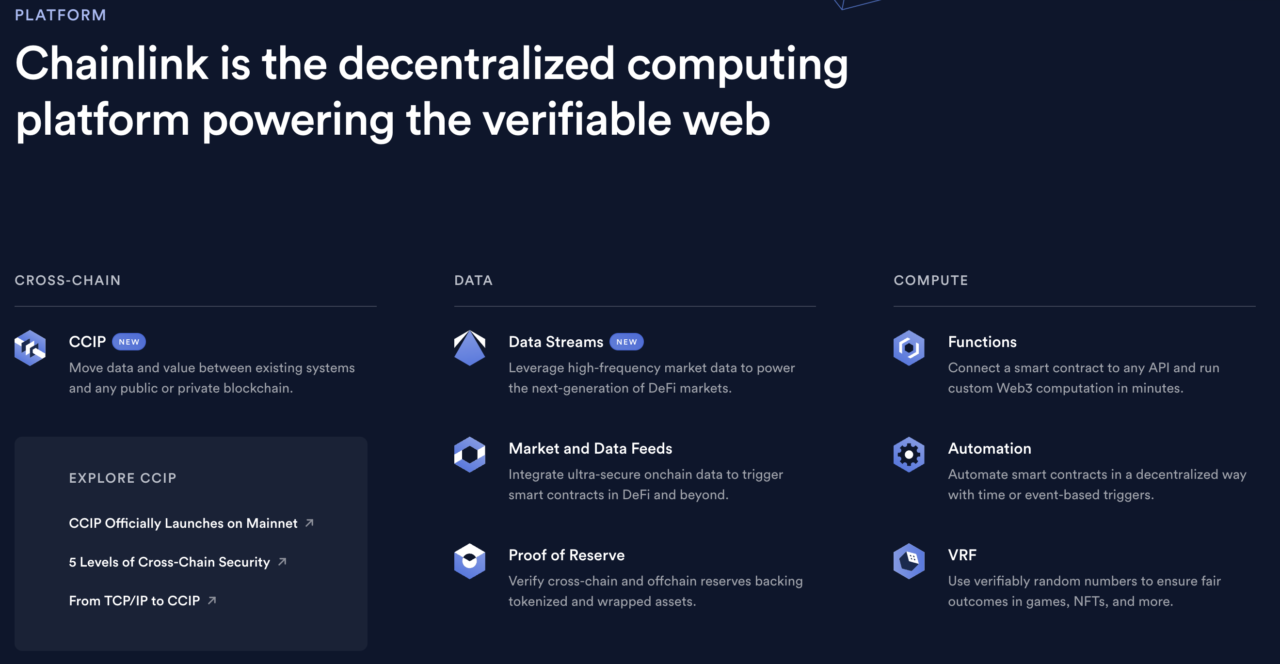

At the heart of blockchain's functionality are smart contracts, self-executing contracts with the terms of the agreement directly written into code. While smart contracts have the potential to automate and streamline a wide range of processes, they are inherently limited by their inability to access real-world data or external systems on their own. This is where Chainlink enters the scene, offering a groundbreaking solution to one of the most pressing challenges in the blockchain ecosystem.

What is Chainlink?

Chainlink is a decentralized oracle network designed to bridge the gap between smart contracts on the blockchain and real-world data. It acts as a middleware, allowing smart contracts to securely and reliably interact with external data feeds, web APIs, and traditional bank payment systems. This capability is crucial for the execution of smart contracts under specific conditions that depend on real-time information, such as market prices, weather data, or other external APIs.

Historical Background and Development

Launched in June 2017 by the company SmartContract, Chainlink was conceived to create a secure, blockchain-agnostic layer. Layer that facilitates data exchange between blockchains and the outside world. Co-founded by Sergey Nazarov and Steve Ellis, Chainlink aims to solve the oracle problem. This problem is the challenge of providing smart contracts with accurate and tamper-proof data without sacrificing decentralization or security.

Chainlink's Role as a Decentralized Oracle Network

Oracles play a critical role in the functionality of smart contracts. It acts as a data feeds that trigger contract execution upon the fulfillment of predefined conditions. However, relying on a single source of truth or a centralized oracle can introduce points of failure and security vulnerabilities. Chainlink addresses these concerns by creating a network of decentralized oracles.

By enabling seamless interaction, Chainlink opens up new avenues for blockchain integration across various sectors. For example finance, insurance, and supply chain management.

How Chainlink Works

The Problem with Smart Contracts

Smart contracts are powerful tools that automate the execution of agreements on the blockchain, ensuring that transactions are processed when predefined conditions are met. However, a significant limitation arises from their inability to natively access or verify external data. This means that without an intermediary, smart contracts cannot interact with any information or systems outside their native blockchain. This limitation severely restricts the scope of applications for smart contracts, confining them to operations that only rely on data available within the blockchain.

The Solution: Decentralized Oracles

Oracles serve as bridges between the blockchain and the external world, enabling smart contracts to access off-chain data. However, traditional oracles introduce a central point of failure, undermining the decentralized nature of blockchains. Decentralized oracles, on the other hand, mitigate this risk by sourcing data from multiple, independent oracles and aggregating it before feeding it to the smart contract. This approach not only maintains the integrity and security of the data but also preserves the decentralized ethos of blockchain technology.

Key Features

Decentralization: Ensuring Data Integrity and Security

Chainlink's decentralized architecture is foundational to its ability to provide secure and reliable data to smart contracts. By distributing the data sourcing and aggregation process across multiple nodes, Chainlink ensures that the data remains tamper-proof and reflective of true market conditions, thereby maintaining the integrity and security of the data provided to smart contracts.

Flexibility: Adaptable to Various Blockchains

One of strengths is its blockchain-agnostic design, allowing it to serve as an oracle solution for any blockchain. This flexibility is crucial for the widespread adoption of blockchain technology, as it enables Chainlink to support a diverse range of applications across different blockchain environments, facilitating seamless data integration and interoperability.

Trustworthiness: Reputation System for Node Operators

Chainlink incorporates a comprehensive reputation system that monitors the performance and reliability of node operators. This system incentivizes nodes to provide accurate and timely data, as their reputation and the potential for future earnings are directly tied to their performance. This not only ensures the reliability of the data provided to smart contracts but also fosters a trustworthy ecosystem of oracle services.

LINK

Overview of LINK, the Native Cryptocurrency of Chainlink

LINK is the native cryptocurrency token of the Chainlink network, designed to facilitate the various operations within its ecosystem. As an ERC-20 token on the Ethereum blockchain, LINK is used as the primary medium of exchange for services on the Chainlink network. It plays a crucial role in ensuring the proper functioning of the decentralized oracle network by compensating node operators for retrieving data, formatting it, and guaranteeing uptime by staking LINK as collateral.

Use Cases of LINK Within the Chainlink Ecosystem

- Node Operator Payments. LINK tokens are used to compensate Chainlink node operators for their efforts in providing secure and reliable data to the smart contracts. This includes rewards for retrieving data, processing queries, and ensuring the data's integrity.

- Staking. Although staking is a feature that is being progressively introduced into the Chainlink ecosystem, it represents a significant use case for LINK tokens. Staking involves locking up LINK tokens as a form of security deposit to guarantee the performance and reliability of node operators within the network.

- Governance. In future developments, LINK might also play a role in the governance of the Chainlink ecosystem, allowing token holders to vote on key decisions and protocols within the network.

Key Takeaways

| Key Takeaway | Description |

|---|---|

| Functionality | Chainlink addresses the oracle problem, providing a secure bridge between smart contracts and external data sources. |

| Decentralized Oracles | Utilizes decentralized oracles to ensure data integrity and security, mitigating the risk of centralized points of failure. |

| LINK Cryptocurrency | LINK tokens facilitate operations within the Chainlink ecosystem, including compensating node operators and potentially governing the network. |

Conclusion

Chainlink represents a pivotal innovation in the blockchain ecosystem, addressing the critical "oracle problem" by providing a secure bridge. Its decentralized oracle network ensures that smart contracts can interact with the real world in a trustless manner. This opens up a myriad of possibilities for automation and decentralized applications.

In essence, Chainlink not only broadens the scope and functionality of smart contracts but also embodies the decentralization and security principles of blockchain technology. Its ongoing development and adoption are testament to the blockchain community's recognition of the need for data exchange mechanisms.

If you are interested in utilizing Chainlink or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

FAQ

What is the problem that Chainlink aims to solve?

- Chainlink addresses the limitation of smart contracts by providing them with access to real-world data and external systems, enabling them to execute based on real-time information securely.

How does Chainlink work to bridge the gap between smart contracts and external data sources?

- Chainlink utilizes a decentralized oracle network to securely and reliably interact with external data feeds, web APIs, and traditional bank payment systems, acting as a middleware between smart contracts and the real world.

What are the key features of Chainlink?

- Chainlink's key features include decentralization, ensuring data integrity and security; flexibility, being adaptable to various blockchains; and trustworthiness, incorporating a reputation system for node operators to maintain a reliable ecosystem.

en

en  pl

pl