Blockchain technology's emergence has transformed our understanding and engagement with various sectors. A notable blockchain application is tokenization, which allows for the representation of real-world or digital assets as tokens on a blockchain. Tokenization has gained considerable momentum due to its ability to improve liquidity, enhance accessibility, and increase the efficiency of asset ownership and transfer.

Introduction

As tokenization thrives, a demand for dependable and effective platforms to launch tokenized assets has arisen. These platforms, referred to as tokenization launchpads, are critical in ensuring the successful issuance and distribution of tokens for different projects. They offer an all-encompassing infrastructure, technological assistance, and fundraising mechanisms that empower businesses and individuals to tokenize and introduce their assets securely and efficiently.

This article intends to examine the vital factors that individuals and companies should take into account when assessing tokenization launchpads. By grasping these crucial factors, potential token issuers can make well-founded decisions and enhance their likelihood of triumph in the tokenization process.

In this article, we will investigate the essential aspects of tokenization launchpads such as security and trustworthiness, technology and infrastructure, tokenomics and fundraising assistance, community and network influence, as well as track records and success stories. By evaluating these elements, individuals and companies can determine the appropriateness and dependability of tokenization launchpads, ultimately optimizing the chances of prosperous token launches.

Understanding Tokenization Launchpads

Tokenization launchpads are specialized platforms that provide a comprehensive ecosystem for token issuers to launch their projects and assets on the blockchain. These launchpads act as a bridge between project creators and investors, facilitating the tokenization process and ensuring a smooth and secure launch.

Purpose

Firstly, the purpose of tokenization launchpads is to simplify the complex process of token issuance and provide a range of services and features that streamline the entire launch process. These platforms typically offer a combination of technological infrastructure, smart contract templates, fundraising mechanisms, community support, and token distribution solutions.

Additionally, by utilizing a tokenization launchpad, project creators can leverage the existing infrastructure and expertise of the platform to tokenize their assets and raise funds through token sales. Moreover, launchpads often provide access to a pool of potential investors, thus increasing the visibility and reach of the project. Additionally, these platforms implement robust security measures to ensure the integrity of the token sale and protect participants from potential fraudulent activities.

Benefits

Tokenization launchpads offer several benefits to both token issuers and investors. For token issuers, launchpads provide a ready-to-use platform that simplifies the technical aspects of token creation, contract deployment, and distribution. They also offer various fundraising mechanisms, such as initial coin offerings (ICOs), initial DEX offerings (IDOs), and decentralized auctions, enabling project creators to raise capital efficiently and effectively.

Investors also benefit from tokenization launchpads by gaining access to a curated selection of vetted projects and investment opportunities. These launchpads often implement due diligence procedures to assess the quality, viability, and potential of the projects listed on their platform. As a result, investors can make more informed investment decisions and reduce the risks associated with participating in token sales.

Moreover, tokenization launchpads contribute to the overall growth and innovation of the blockchain ecosystem. Additionally, they foster collaboration, community engagement, and knowledge sharing among project creators, investors, and other stakeholders. By providing a platform for emerging projects, tokenization launchpads stimulate the development of new use cases, applications, and solutions built on blockchain technology.

In summary, tokenization launchpads play a pivotal role in the tokenization process by providing a comprehensive ecosystem that simplifies the issuance and distribution of tokens. These platforms offer technological infrastructure, fundraising mechanisms, community support, and security measures to ensure a successful and secure token launch. Moreover, by leveraging the services and features provided by tokenization launchpads, project creators and investors can harness the potential of blockchain-based tokenization for innovation and growth.

Key factors for evaluating tokenization launchpads

Security and Trust

Security is a critical factor to consider when evaluating tokenization launchpads. Token issuers and investors need assurance that their investments and assets are protected from potential threats and vulnerabilities. It is essential to thoroughly assess the launchpad's security measures and protocols. This includes evaluating whether the launchpad undergoes regular security audits conducted by reputable third-party firms. Audits help identify potential vulnerabilities in smart contracts and ensure the launchpad follows industry best practices for security. Additionally, examining the launchpad's code review processes, secure infrastructure, and adherence to strict security standards can further enhance confidence in the platform. Another important aspect is reputation. Researching the launchpad's track record and reputation in the industry can provide insights into its reliability and trustworthiness. Assessing user reviews and feedback, as well as the launchpad's history of successfully completed projects, can contribute to the evaluation process.

Technology and Infrastructure

The technology and infrastructure provided by a tokenization launchpad are crucial for the success of a token launch. Compatibility with different blockchain networks is a vital consideration. Assessing whether the launchpad supports popular blockchain platforms, such as Ethereum or Binance Smart Chain, ensures that the tokenized assets can benefit from the network's ecosystem and liquidity. Furthermore, evaluating the launchpad's ability to handle high volumes of transactions efficiently is important. Transaction speed and scalability are critical factors that impact the user experience and the ability to process a large number of token transactions. A launchpad that offers fast and scalable infrastructure ensures smooth token launches and reduces the risk of congestion or delays. Additionally, the availability of developer tools and smart contract templates can streamline the project creation process. Evaluating the launchpad's developer-friendly features, documentation, and support can provide valuable insights into the ease of building and customizing tokenized projects.

Tokenomics and Fundraising Support

Tokenomics refers to the economic model and distribution mechanisms of tokens. Evaluating the launchpad's tokenomics model is essential to understand how the token supply is structured, any token lock-up periods, and the distribution mechanism for token sales. A well-designed tokenomics model should align with the project's goals, provide incentives for token holders, and maintain a fair distribution of tokens. Furthermore, assessing the launchpad's fundraising support is crucial. This includes understanding the mechanisms available for token sales, such as initial coin offerings (ICOs), initial DEX offerings (IDOs), or decentralized auctions. The launchpad should provide clear guidelines and procedures for token sales, including KYC (Know Your Customer) requirements, compliance measures, and token sale terms. Additionally, the launchpad's ability to facilitate liquidity through features like liquidity pools or partnerships with decentralized exchanges (DEXs) can enhance the token's tradability and marketability.

What is tokenomics?

Community and Network Effect

The strength and engagement of a launchpad's community and its network effect play a significant role in the success of a token launch. A strong community can provide valuable support, feedback, and visibility for the project. Partnerships and collaborations with other projects and organizations within the blockchain ecosystem are also noteworthy. A launchpad that has established strategic alliances and ecosystem development initiatives demonstrates its ability to attract a broader network of stakeholders, including investors, developers, and influencers. Moreover, a vibrant and interconnected network can enhance the project's exposure, attract potential investors, and foster collaboration opportunities.

Track Record and Success Stories

Evaluating the launchpad's track record and success stories provides valuable insights into its past performance and the outcomes of previous token launches. Researching the launchpad's history of completed projects can shed light on the level of support and success achieved by token issuers using the platform. Factors to consider include the token price appreciation after launch, the project's performance in terms of development milestones and achievements, and the level of engagement from the launchpad's community. Additionally, analyzing feedback and reviews from past token issuers can provide insights into the launchpad's responsiveness, transparency, and overall user experience. Assessing success stories can help gauge the launchpad's ability to provide ongoing support to projects beyond the initial token sale and contribute to their long-term growth.

Careful consideration of these essential aspects enables token issuers to make thoughtfully informed decisions when choosing a suitable launchpad. Thorough research and due diligence are crucial to improve the chances of creating a positive experience for all participants in a token launch.

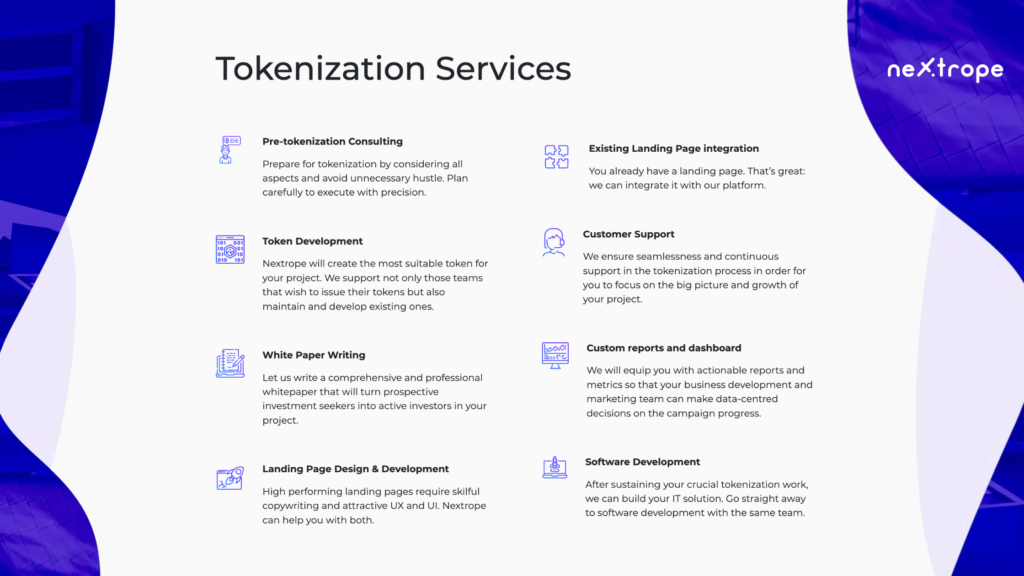

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a month and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

Our platform allows you to participate in the broad financial market of digital assets. Expand your reach and find investors globally. Tokenize your project and start raising capital within a month!

Read more about Nextrope Tokenization Launchpad Platform and Contact Us!

en

en  pl

pl