Over the past few years, tokenization has surfaced as an innovative technology with immense potential to transform numerous industries. Through blockchain implementation, artificial intelligence, and cryptocurrencies, companies can tokenize their assets and services, facilitating fractional ownership, improved liquidity, and heightened transparency. Nevertheless, addressing the intrinsic risks linked to this cutting-edge approach is crucial as tokenization gains traction.

Mitigating risks in tokenization initiatives necessitates conducting extensive due diligence, especially when employing launchpads. Launchpads function as platforms that aid in fundraising and initiating tokenized projects. Ensuring the security and integrity of these initiatives is vital to protect investor interests and establish trust in the tokenization environment.

What does Launchpad Due Diligence mean?

Launchpad due diligence is the exhaustive evaluation process conducted before participating in a tokenized project via a Launchpad platform. It entails thoroughly inspecting various project aspects, such as technical infrastructure, legal compliance, team expertise, market potential, and community engagement. The objective is to detect any potential dangers, susceptibilities, or warning signs that may affect the project's success or jeopardize investor funds' security.

Serving as a precautionary measure, launchpad due diligence confirms that tokenized projects comply with stringent standards of safety, clarity, and regulatory adherence. It offers prospective investors and contributors an in-depth understanding of the project's viability, trustworthiness, and associated risks. By performing due diligence, participants can make educated choices and reduce the chances of falling prey to scams or poorly executed initiatives.

Considering both technical and non-technical facets, launchpad due diligence encompasses a multidimensional evaluation. Beyond scrutinizing a project's whitepaper or its technological framework, it delves into appraising team capacity, legal conformity, and market feasibility. Through this stringent assessment procedure, launchpad due diligence strives to safeguard investors and guarantee the enduring success of tokenization endeavors.

By underscoring the importance of launchpad due diligence, tokenization participants can reduce risks, amplify project credibility, and contribute to the overall expansion and stability of the tokenization ecosystem. In the sections below, we will examine the necessity of due diligence for tokenization projects and explore the fundamental elements of launchpad due diligence.

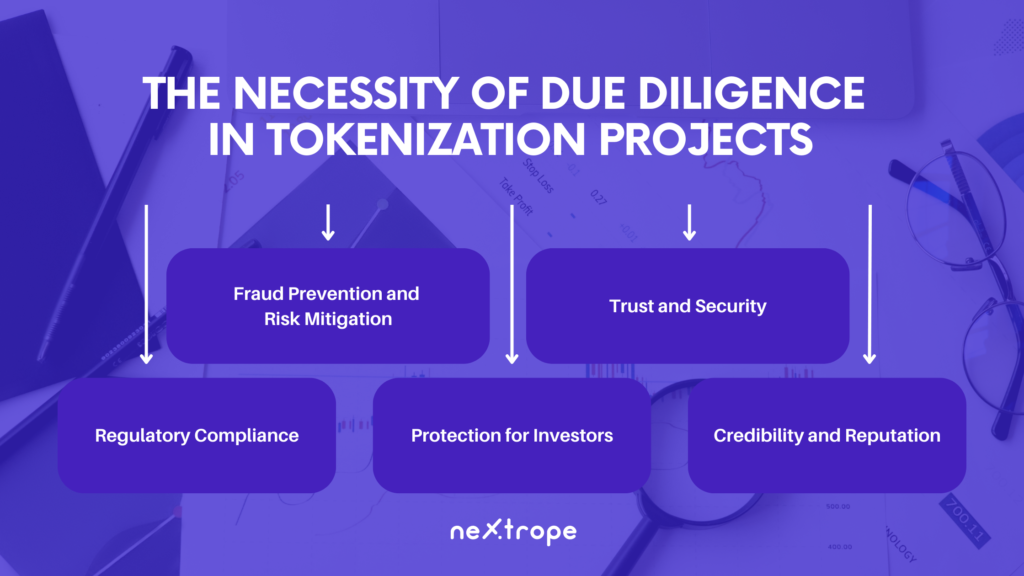

The Necessity of Due Diligence in Tokenization Projects

Tokenization projects present exciting prospects for businesses and investors by allowing fractional ownership of assets and establishing new methods of value exchange. Nevertheless, these opportunities are accompanied by inherent risks that must be thoroughly assessed and managed through due diligence. Here are various reasons explaining the importance of due diligence for tokenization projects

Fraud Prevention and Risk Mitigation

Identifying and alleviating possible risks associated with tokenization projects is a crucial function of due diligence. It assists in exposing deceptive schemes, scams, and false claims that can mislead investors and other participants. Thorough due diligence can reveal potential warning signs, helping participants avoid fraudulent endeavors and secure their investments.

Trust and Security

Tokenization projects frequently employ blockchain technology and smart contracts, necessitating strong security measures. Evaluating the security mechanisms, code quality, and possible vulnerabilities within the underlying technical infrastructure is facilitated by due diligence. A technical audit can uncover potential security hazards, which can be addressed to ensure the tokenization project's dependability and integrity.

Regulatory Compliance

Adherence to legal and regulatory standards is vital to the long-term triumph and stability of tokenization projects. Due diligence encompasses examining and determining the project's compliance with relevant laws, regulations, and recommendations. This analysis includes assessing the project's obedience to Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, securities laws, and data protection regulations. Compliance with regulations mitigates legal risks while boosting investor and stakeholder confidence.

Protection for Investors

Conducting due diligence is essential to safeguarding investors' interests in tokenization projects. By scrutinizing a project's whitepaper, team qualifications, and financial forecasts, prospective investors can evaluate the project's feasibility and potential return on investment. Comprehensive due diligence aids in recognizing projects featuring solid business models, skilled teams, and viable growth probabilities—thereby minimizing the chance that investors will lose their funds to ill-conceived or fraudulent initiatives.

Credibility and Reputation

Launchpad due diligence enhances the overall esteem and reliability of the tokenization ecosystem. By performing extensive evaluations, both launchpad platforms and project teams showcase their devotion to accountability and ethical practices. Projects that emphasize due diligence and supply thorough documentation encourage confidence in potential investors, drawing more participants and cultivating a thriving, sustainable tokenization environment.

Essential Elements of Launchpad Due Diligence

A thorough assessment process is vital in launchpad due diligence, addressing multiple crucial components to guarantee the security, reliability, and success of tokenization initiatives. Examining these aspects enables potential investors and participants to make educated choices and minimize tokenization-related risks. The following are the main components of launchpad due diligence

In-Depth Project Assessment

This component involves a detailed evaluation of the tokenization project, including examining its whitepaper and scrutinizing its business model, roadmap, financial forecasts. Determining the project's feasibility and scalability is essential to predict its likelihood of success. Furthermore, comprehending the market consequences and competitive environment can offer insights into the project's sustainability and long-term growth potential.

Technical Inspection

Performing a technical review is crucial for evaluating the security and functionality of the blockchain infrastructure underpinning the tokenization initiative. This component consists of scrutinizing the project's smart contracts, conducting code assessments, and analyzing the network architecture. Identifying and addressing possible vulnerabilities, bugs, or inadequacies in the code through examining technical aspects ensures a strong and secure foundation for the tokenization endeavor.

Legal and Regulatory Adherence

Abiding by relevant legislation and regulations is vital for a tokenization project's legitimacy and long-lasting success. Launchpad due diligence encompasses an exhaustive review of legal documents such as terms of service, privacy policies, and regulatory submissions linked to the project. Ensuring compliance with Know Your Customer (KYC), Anti-Money Laundering (AML) regulations, securities laws, and data protection regulations is imperative to minimize legal risks and safeguard participant interests.

Team Examination

Evaluating the proficiency, background, and credibility of the project team is a key aspect of launchpad due diligence. This assessment entails reviewing team members' qualifications, experience, and accomplishments. Exploring their past projects, roles, and contributions to the blockchain and cryptocurrency sectors helps establish their capability and likelihood of successfully executing the tokenization project. A qualified team with a strong reputation inspires confidence in investors and stakeholders.

Market and Community Analysis

Assessing the project's community involvement, social media footprint, and market perceptions is crucial to estimating its potential adoption and achievement. Launchpad due diligence incorporates evaluating the project's engagement across various channels, such as Telegram, Twitter, or Discord, to comprehend community support and interaction levels. Moreover, performing market analysis and understanding the competitive landscape offer valuable insight into potential market positioning and demand for tokenized products.

By addressing these essential components during launchpad due diligence, potential investors and participants can obtain a comprehensive view of a tokenization project's strengths, weaknesses, risks, and possible rewards. Rigorous evaluations of the project as a whole, its technical facets, legal compliance, team capabilities, and market dynamics contribute to making well-informed investment decisions and promoting a secure and reliable tokenization environment.

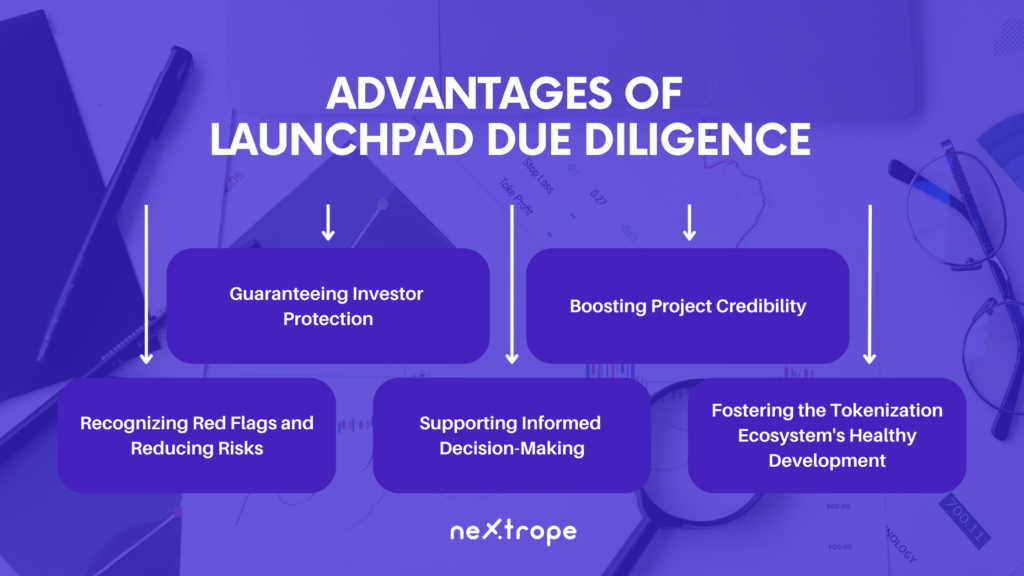

Advantages of Launchpad Due Diligence

There are numerous advantages to performing launchpad due diligence, particularly for those involved in tokenization projects. By emphasizing the importance of due diligence, both investors and stakeholders can protect their interests. The following are the primary advantages of launchpad due diligence.

Guaranteeing Investor Protection

A critical protective measure for investors is provided by launchpad due diligence. In-depth evaluations can identify and prevent possible scams, deceptive projects, and inadequately executed initiatives. Due diligence reveals red flags and warning signs, allowing investors to make educated decisions and reduce the likelihood of losing their investments. Establishing trust and confidence in the tokenization ecosystem is made possible by safeguarding investors' interests.

Boosting Project Credibility

Rigorous due diligence serves to increase the credibility and trustworthiness of tokenization projects. Launchpad platforms and project teams that prioritize due diligence demonstrate their dedication to transparency, responsible operations, and high-quality standards. Comprehensive assessments and thorough documentation grant prospective investors access to vital information for gauging a project's credibility. A well-prepared due diligence report can entice additional investors, form partnerships, and promote long-term project success.

Recognizing Red Flags and Reducing Risks

Identifying potential risks and weaknesses related to tokenization projects is made possible through launchpad due diligence. Various factors, including a project's technical infrastructure, legal compliance, team abilities, and market analysis, are evaluated to detect potential red flags. This proactive strategy allows participants to handle issues before they escalate into major problems, reducing project failure likelihood as well as fraud or security breaches.

Supporting Informed Decision-Making

Comprehensive information for informed investment decisions is supplied by launchpad due diligence. Thorough evaluations of a project's feasibility, scalability, legal compliance, and team expertise enable investors to determine the likelihood of project success. This empowers them to balance risks and rewards, tailor investment strategies, and select projects that correspond with their objectives and risk tolerance.

Fostering the Tokenization Ecosystem's Healthy Development

Participants contribute to the tokenization ecosystem's overall growth and stability by carrying out launchpad due diligence. In-depth assessments aid in identifying and supporting legitimate projects with solid foundations, skilled teams, and viable business models. This cultivates an atmosphere that encourages responsible innovation while drawing more participants, investors, and businesses to the tokenization arena.

In summary, launchpad due diligence provides substantial benefits, such as ensuring investor protection, bolstering project credibility, spotting red flags, enabling informed decision-making, and fostering the tokenization ecosystem's healthy growth. By prioritizing due diligence, participants can reduce risks, encourage transparency, and build a foundation of trust within the continually evolving world of tokenization.

Conclusion

Undertaking due diligence on Launchpad is a vital process for guaranteeing the safety, reliability, and prosperity of tokenization endeavors. By performing comprehensive evaluations of the project, technical framework, legal adherence, team proficiency, and market forces, participants can make well-informed choices while minimizing potential threats. Placing emphasis on due diligence is crucial for cultivating confidence, drawing investments, and encouraging responsible expansion in the thrilling realm of tokenization.

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a month and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

Our platform allows you to participate in the broad financial market of digital assets. Expand your reach and find investors globally. Tokenize your project and start raising capital within a month!

If you are looking for a software house that will become your reliable technology partner in the tokenization process, our experts are ready to help you at any stage of it. After years, we simply know the basics of stunning projects. Let our experience become your success. Read more about Nextrope Tokenization Launchpad Platform and Contact Us!

en

en  pl

pl