NFTs - this is definitely their year. During last months NFTs were discussed all over the world. The gaming industry seems to be their natural environment. Yet how can video games make use of NFT?

NFT stands for Non Fungible Tokens. But what does it mean? Among various blockchain token types we differentiate between fungible and non-fungible tokens.

Examples of the first kind are Bitcoin or Ether. Fungible means that a single token is indistinguishable from others in the same ecosystem. Just like in regular currency. Thanks to that they can be used for payment transactions.

Definition:

NFT’s non-fungibility means that each and every token in the system is unique. NFTs don’t have a standard value and often do not allow for an equal exchange (NFT for NFT). Each token represents unique information of ownership or identity.

In the blockchain world, NFTs are digital assets that represent a unique or rare digital or real item. Sounds familiar?

NFT in video games

Gaming industry is a powerful branch fueled by its consumer’s passion. When gamers launch their favorite title, they immerse themselves in a new, alternative world. A quick look at the most popular games of the last decade, like League of Legends, Fortnite, or Counter-Strike, is enough to see how modern gamers care about their characters, skins, and other in game items. They treat them as an extension of their creative self. What’s important: how much are they willing to pay for these.

The will to build a collection of unique items is nothing new. The video games showed us how far beyond the real world this phenomenon can reach. But do the purchased items really become their property? Do these items differ somehow from the ones possessed by others, are they really rare? Often the answer is not so simple. During last few months, NFTs showed us that they may change that.

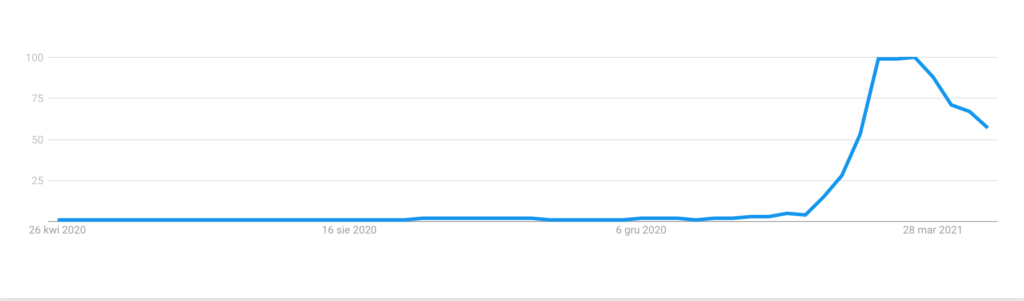

"NFT" Search Frequency. Source: Google Trends

"NFT" Search Frequency. Source: Google Trends

NFT games

The first and most popular NFT standard is ERC-721. Its first commercial use was an NFT game, CryptoKitties, that allows the players to buy, collect, and sell virtual kitties. Since the game’s debut in 2017, Dapper Labbs made over 40 million USD off of it. CryptoKitties were first game of this kind which started a whole new trand.

It seems like collectible blockchain games are the perfect environment for NFT. They allow the players to buy unique items, and to keep full ownership of the purchased assets. That’s why we have seen a rapid growth of projects of such type during the last year.

The effect of NBA and aforementioned Dapper Labbs’ collaboration - NBA Top shot - is a great example of nft collectible game. On this platform, basketball fans can buy and sell video clips - “moments” from last season’s games that are blockchain NFTs.

CryptoSlam estimates that up to this date total value of all transactions at NBA Top shot reached over 370 million USD. NBA Top shop is clearly one of the most popular NFT games, which enable fans to own NFTs connected with their favorite form of entertainment.

NFT video game

NFT’s potential reaches far beyond only collectible games. Let’s take for example multiplayer games like the aforementioned LOL or Fortnite. Possessed skins and champions are of great importance to the players. NFT allows the buyers to claim ownership over unique digital products.

What if it was implemented for rare and difficult-to-obtain game items they purchase? What if also in these cases the players had full control over ownership rights which they can trade with other players? The same could be applied for limited editions of character skins.

Potential use of NFT in video games:

- Championship cards and video game titles

- Limited items granted for participation in events.

- Game codes

- Rare weapon, in-game items, or characters skins

- Commemorative recordings of the most interesting moments from e-Sport.

- Subscription tokens

Immutable X

Released in April 2021, the Immutable X platform became the first Layer 2 solution dedicated to NFT tokens. Behind its creation is an Australian team Immutable, responsible for the NFT-based card game - Gods Unchained. The platform allows for trading and selling unique items that players have acquired in the form of ERC-721 tokens. According to its creators, it is Immutable X that will allow for mass adoption of NFT in games.

Layer 2 for NFT games

In 2020, Immutable in collaboration with StarkWare developed a solution that allows you to enjoy the security and other benefits of the Ethereum network without paying high fees. Until now, it has been gas fees that have been an indispensable part of creating and trading NFT for games, which experts believe has hampered further development of the technology.

Immutable X was built on top of the scaling Layer 2 technology created by StarWark. Thus, the platform became the first Layer 2 solution dedicated to NFT. This allows game developer to take advantage of the security provided by Ethereum without having to pay gas.

NFT in gaming industry - summary

NFT market is one of the fastest developing branches of DeFi world. Recently we can observe a true boom among NFT marketplaces. Thanks to blockchain technology new possibilities emerge and when it comes to video games whole industry may use them.

Last year’s experience shows that even the biggest gaming companies are not afraid to stray from the trail and introduce innovations. NFT can become one of them. Obviously, a wider use is only a song of the future, but all signs point to it happening quicker than we may anticipate.

Do you want to know how NFT would work in your project? Consult our experts at Nextrope for free. Contact us at contact@nextrope.com.

en

en  pl

pl